Make a plan for what you’ll sell online, who you’ll sell it to, and how—using these 10 steps.

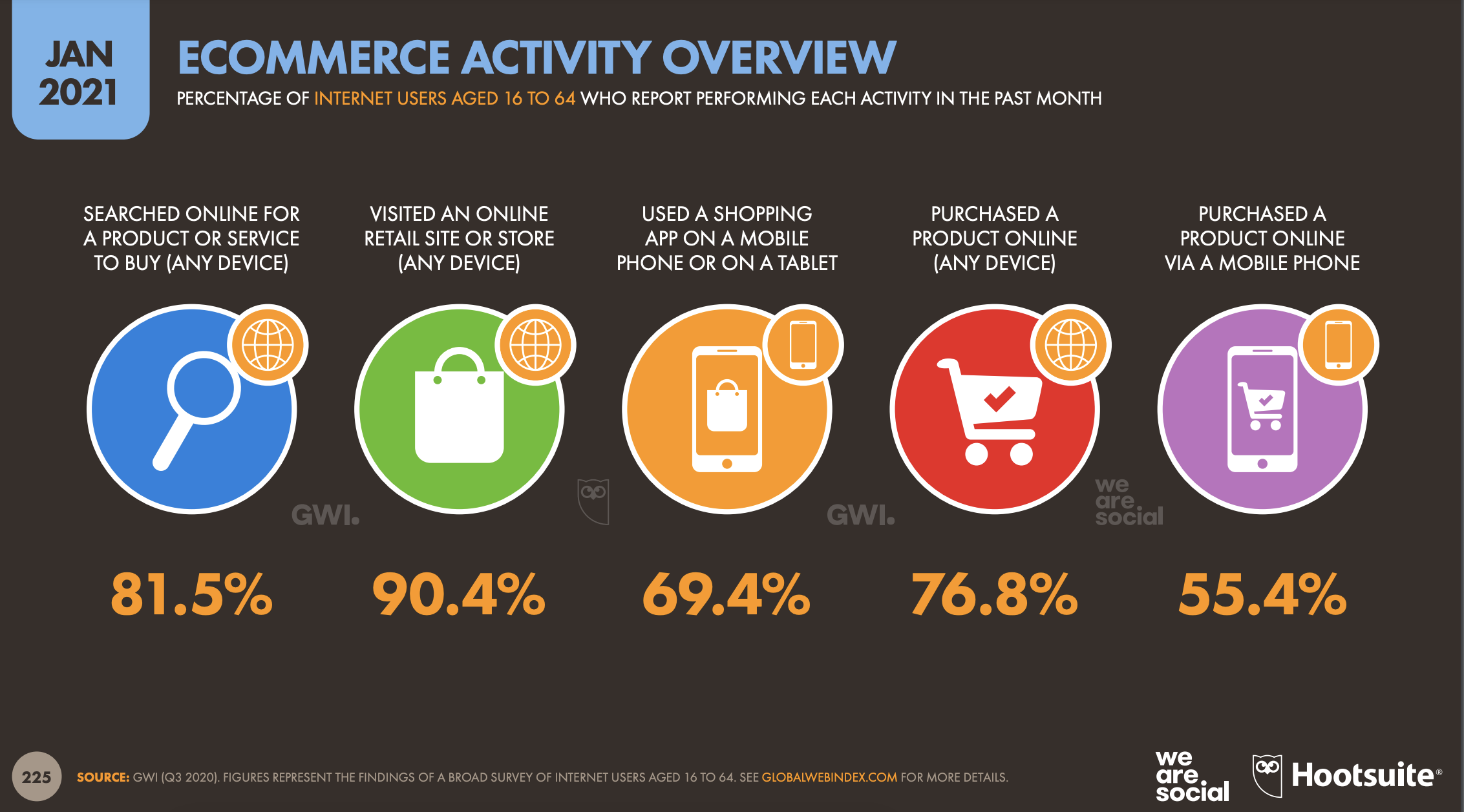

The world of e-commerce holds great promise for small businesses. In the U.S. in 2020 alone, online sales increased 44% and represented 21.3% of total retail sales for the year. Of course, the coronavirus pandemic had something to do with the jump, but these numbers had already been steadily on the rise. If you have a brick-and-mortar business that you envision bringing online or if you’re thinking of launching a product for the first time, this could be your moment.

Selling products online may seem like a straightforward proposition—and it can be, once you’re up and running. But you’ll have to do some research first: You need to find products you want to sell, figure out who your potential buyers are, and determine how you’ll deliver those products seamlessly into your customers’ hands. This preparation will provide the foundation for a winning e-commerce strategy. After all, when you think about how to start a business online, knowing how to sell your product is essential.

Here’s your 10-step guide for how to sell a product online.

1. Find your products

There are 3 ways most online sellers source products: do it yourself (DIY), wholesale, and drop-shipping. Each method has its own benefits and drawbacks. Whatever method you choose, when you think about how to sell a product online, look for products that you feel passionate about and that meet a need in the marketplace.

DIY product

These are products you make yourself, whether it’s a small-batch baking hobby you’re turning into a business or a 3D print factory in your garage. DIY items are usually the most expensive products to produce, but they can also be the most gratifying if you have a creative urge.

In many cases, you can charge a premium for handcrafted or highly specialized items, just be sure to factor in the time it takes to make the product. Be prepared to reassess your process and strategy if you can’t charge enough to make the business sustainable.

Wholesale products

The traditional retail model is to buy items in large lots from a manufacturer or wholesaler and sell them individually. You can find wholesale items on sites like Alibaba and Etsy Wholesale. You can also find suppliers by searching for wholesale lots on eBay.

Be sure to check your source carefully. Read reviews, look at Better Business Bureau (BBB) listings, and ask lots of questions before you place your first order. You want to make sure that the products you purchase are of high quality and match the specifications in person that they claim online.

Dropshipped products

In the dropshipping model, you market the products and take orders, but your supplier handles fulfillment. The convenience is offset by a lower profit margin and tough competition—there are many other online shops offering the same merchandise. Popular drop-shipping suppliers include Oberlo, AliExpress, Wholesale2B, Inventory Source, and Megagoods.

The best way to compete in the dropshipping market is to select a cohesive catalog of items and market them to a niche audience.

2. Identify your niche market

The market is massive for an online seller, but it’s also competitive. The best way to stand out is to find a niche.

Narrow it down

For instance, if you wanted to sell yoga mats, you’d be up against brands that are already well established in the market. But if you decided to sell yoga mats designed for travel, with hand-painted designs that might increase the cost, you could target a more specific audience—like globetrotting women between the ages of 40 and 55.

Think about your own niche

One way to begin with niche marketing is by thinking about areas where you already have a presence—and perhaps a passion. Maybe your niche market is one that you’re already involved in. Are you a member of any social media groups, message boards, or other online gathering places? Is there a niche where people know you or do you have a lot of contacts? If so, that offers a meaningful place to start.

Make sure it’s viable

Whether or not you have a personal relationship with the niche you’re considering, being informed about your market is key. To get to know your niche:

- Use Google Trends to see what’s popular.

- Join social media groups and online communities related to your market to see what people are talking about.

- Monitor what’s hot on sites like Trend Hunter and Trendwatching.

- Check out your competition and see if you can fill a gap.

- Use the Google Ads Keyword Planner tool to see how big the market is for your niche.

3. Conduct market research

Once you know who you want to sell to, it’s time to figure out if those people will buy what you plan to offer—and if so, how much they’re willing to pay. This means you must assess the value you can offer in your market. Questions to research about how to sell a product online include:

- Is the market for your products growing or shrinking?

- How satisfied are people with the existing products in your market?

- What needs aren’t being met?

- What features do people value?

- What is the average price point of your competitors’ products?

- What are your potential customer’s pain points

Study your competitors

You need to determine if there will be a sustainable demand for your product at the price you’ll ask. Start by looking at your competition. Are your competitors doing well and expanding, or do you see companies going out of business? What are your most successful competitors doing right? What’s missing from the online sales marketplace?

Ask your audience

Conduct surveys—formally and informally—to see how people react to your product idea.

As you begin to flesh out your idea, post about it in a social media group and ask for input. You can also find people in your niche to interview in person and ask them about their needs, the products they love, and their reactions to your product ideas.

Once your idea is more developed, online surveys provide a simple, streamlined way to understand what people in your target market want and need. Plus, you can use this opportunity to collect their contact information, grow your audience, and then follow up when your product is for sale. Check out how Mailchimp’s free online survey maker stacks up against the competition.

Price it right

When looking at competitors, don’t make the mistake of assuming that a lower price is automatically better. People are willing to pay a premium price for high-quality products. On the other hand, if your target customers feel that your competitors’ products are overpriced, you could step in to offer them a more economical alternative.

4. Create buyer personas

A buyer persona is a visualization of your target market as a specific person. Buyer personas are a way to refine your thinking about how to sell a product online and personalize your marketing.

Betsy and Lucy

Using the example of hand-painted yoga mats targeted at female travelers over 40, imagine marketing to a specific woman. But who is she?

You might imagine her as Betsy, a fitness buff with a high discretionary income who likes to take cruises to the Caribbean with her friends. Betsy would love to have a one-of-a-kind yoga mat that’s easy to transport, works well under various weather conditions, and that her friends admire at the yoga classes they take together at resorts and on cruises.

Or you might imagine her as Lucy, a frequent business traveler who often works late into the night. A hand-painted yoga mat would give her a reason to take time out for herself and enjoy a relaxing practice.

In this example, the personas are Betsy and Lucy—fictional people you keep in mind to make your marketing more relevant and human.

Target each persona differently

The images, language, and price point you would use to market to Lucy might be slightly different from the ones you would use to reach Betsy.

Betsy would probably respond well to an image of a resort yoga class, with rows of solid-color mats and one beautiful hand-painted one that stands out from the rest. Betsy would pay a premium price to have that mat. However, Lucy might respond to an image of a well-appointed hotel room with one candlelit corner, where a woman sits in meditation on a colorful mat.

Your business can have more than one buyer persona, with ads and even product lines targeted to each one. Each persona should be fleshed out with details like:

- Age

- Gender

- Income

- Hobbies

- Interests

- Family/relationships

- Values

- Priorities

- Favorite social media channels

- Club memberships

5. Brand your business

Your brand identity is built on your logo, website, marketing materials, and other communications with customers. If you make deliberate choices, you can shape your brand identity to be unique and appealing to your customers.

The best way to begin this process is to summarize the qualities you want your brand to convey in just a few words. Is it funky, friendly, and casual? How about sturdy, high-quality, and reliable? Could it be youthful, vibrant, and fun? In the case of a business that sells hand-painted travel yoga mats, the brand might be artistic, unique, and uplifting.

Brand persona

One way to distill your brand identity is to give it a persona, too. Imagine your brand as a cartoon character: What does it look like? How old is it? Does it have a gender? How does it sound? How does it dress? What kind of things does it do? Is it a surfer, a college professor, a bookworm, a hippie, an artist, a nature lover?

Your brand identity will be expressed in the way you use language, your logo, the images you choose, and the colors you select. If you make those choices without a plan, your brand will be hard for customers to discern. Here’s what to focus on for a strong brand identity.

Visual identity

Every brand has a recognizable, consistent look that’s tied together with color, a logo, and your product imagery.

Choose a color palette with one main color and 2 or 3 secondary colors that express your brand identity—for example, red is often perceived as bold, dark blue as luxurious, and green as organic. Keep in mind that color associations are often culturally specific, and what appeals to customers in one part of the world may not communicate the same things in another.

Your logo should be simple and expressive. Complicated designs don’t work well when printed in small spaces or if reproduced in black and white. Since your logo will be on everything you create, it should be carefully built to convey your brand’s identity. You can create one yourself using a free online logo creator such as Canva (most will charge you to download your design) or hire a graphic designer.

The images you choose for your website, advertising, and social media should be consistent and express your brand’s image clearly.

For example, the yoga mat brand would market to its 2 personas with imagery in a specific context for each—either a resort class or a hotel room—with a spotlight on the product. That’s a consistent type of image that could quickly become associated with the brand and convey the brand’s identity.

Brand voice

Your words should be carefully chosen to protect your brand’s identity—this is your brand voice.

Keep in mind your buyer personas and your brand persona when writing copy. Who are you talking to, and how are you talking to them? Are you a fun friend, a knowledgeable expert, or a calming confidant? This will help you hone your brand voice and keep it consistent across channels—email, product copy, social media, and advertising. Here are areas in which you can be deliberately expressive:

- Headlines

- Ad copy

- Website copy

- Product names

- Email automation

- Social media posts

- Phone greetings

To help stay on track, you might make a list of certain words you’d like to incorporate into your copy often—for the yoga mat sales, these might include “artistic,” “elegant,” and “unique.”

6. Build your e-commerce website

Building an online store has never been easier. And when you build your website in Mailchimp, it can also be free.

Start by creating a website that incorporates the elements of your brand identity. Using Mailchimp’s content studio, you can upload your logo, photos, colors, and other files to incorporate into your website and then use them across marketing channels to stay on brand.

Make sure your website design makes it easy for shoppers to find your products. Upload images, write specifications and include details about shipping so that your customers understand exactly what they’re buying (and why they should). Simply add a Stripe buy button to your fresh new website, and you’re ready to start selling.

Sell via landing pages

If you’re not ready to build a full website, Mailchimp shoppable landing pages offer another speedy way to get your products for sale online. These are a particularly good solution when you want to focus on a single item, test an idea, launch a new product, or run a promotion. Best of all? They’re also free. You can even set up Facebook ads to drive traffic to your landing page from right inside your Mailchimp account.

7. Set up processes for payment, shipping, and staying in touch

Before you start selling online, you’ll need to have systems in place for collecting payment and shipping things out.

With a website built in Mailchimp, you’ll connect a Stripe account to start selling. If you build a landing page instead, you can connect to Stripe or to Square. Either way, be sure you understand their fees and take them into account when you price your products.

If you’ll be handling shipping yourself, you’ll need accurate numbers to set up your shipping options on the site. If your company is US-based, compare pricing and services from the USPS, UPS, and FedEx—or look at other options in the country where you’re headquartered.

Customers love free shipping, but if you plan to offer that, those costs should be built into your product pricing. Also, don’t forget to add in the cost of boxes and packaging materials when you set up your pricing and shipping rate structure.

When someone makes a purchase, be sure that their information is stored using customer relationship management (CRM) software. That way, you can send order notifications, follow up after their purchase, and keep in touch to build customer loyalty.

8. Create high-quality product content

Ideally, your site would be assembled by experienced copywriters, photographers, and marketing professionals. Realistically, that’s not how most small businesses operate.

If you’re doing it all yourself, here are some tips.

Images

Your images should accomplish 2 things: Make the product look desirable and align with your brand image.

If your product supplier provides you with professional product photos, check to see what rules you need to comply with when you use them. If you’re allowed to alter them, consider cropping them and adding your own logo to make them unique to your site.

If you’ll be taking your own photos, you don’t need the best, most expensive equipment. Many of today’s smartphones take amazing photos. Keep these things in mind to get good shots:

- Set up bright lighting. Use shop lights, take the shades off lamps and move them close, or use natural light. If you’ll be photographing a lot of smaller items, invest in an inexpensive lightbox.

- Lean in. You’ll get much better results if you move closer to the product.

- Get level. Instead of photographing your product from above, get down to eye level with it and snap some close-up shots.

- Highlight details. You don’t have to frame the entire product in every photo. Take shots of specific details that show why your viewer should want this product.

- Take tons of photos. Even pros take hundreds of shots to get one great photo. Try a variety of cameras and phones if you can, and shoot from different angles and in different lighting.

For each product, choose one signature image plus several detailed images. It’s good for search engine optimization (SEO) to give your image file names that include your target keywords when you upload them or add alternative (alt) text.

Description

Your product descriptions should be thorough, but easy for a busy person to take in at a glance.

- Don’t waste headline space. Use descriptive product names that tell people (and search engines) exactly what the item is—like “Hand-Painted Lotus Travel Yoga Mat” instead of just “Lotus Mat.”

- Start with an overview. At the top of the page, tell people in a sentence or 2 why they should care about this product and how it meets their needs.

- Be brief. When busy people see a wall of text, they often click away. Limit yourself to a couple of short paragraphs.

- Use topic headings. Headings can break up the page and make it scannable. Some people will only skim the headings and not read the text below, so choose compelling, descriptive words for your headings, and include keywords when possible.

- Make the details digestible. Use bulleted lists to keep your page attractive and readable.

- Solicit reviews. Always encourage your customers to leave reviews. Consider offering free products in exchange for honest reviews to a limited group of people to get your first reviews on the page.

9. Promote your products

When your website or landing pages are built and you’re ready to sell, there are many ways to get your product in front of potential customers:

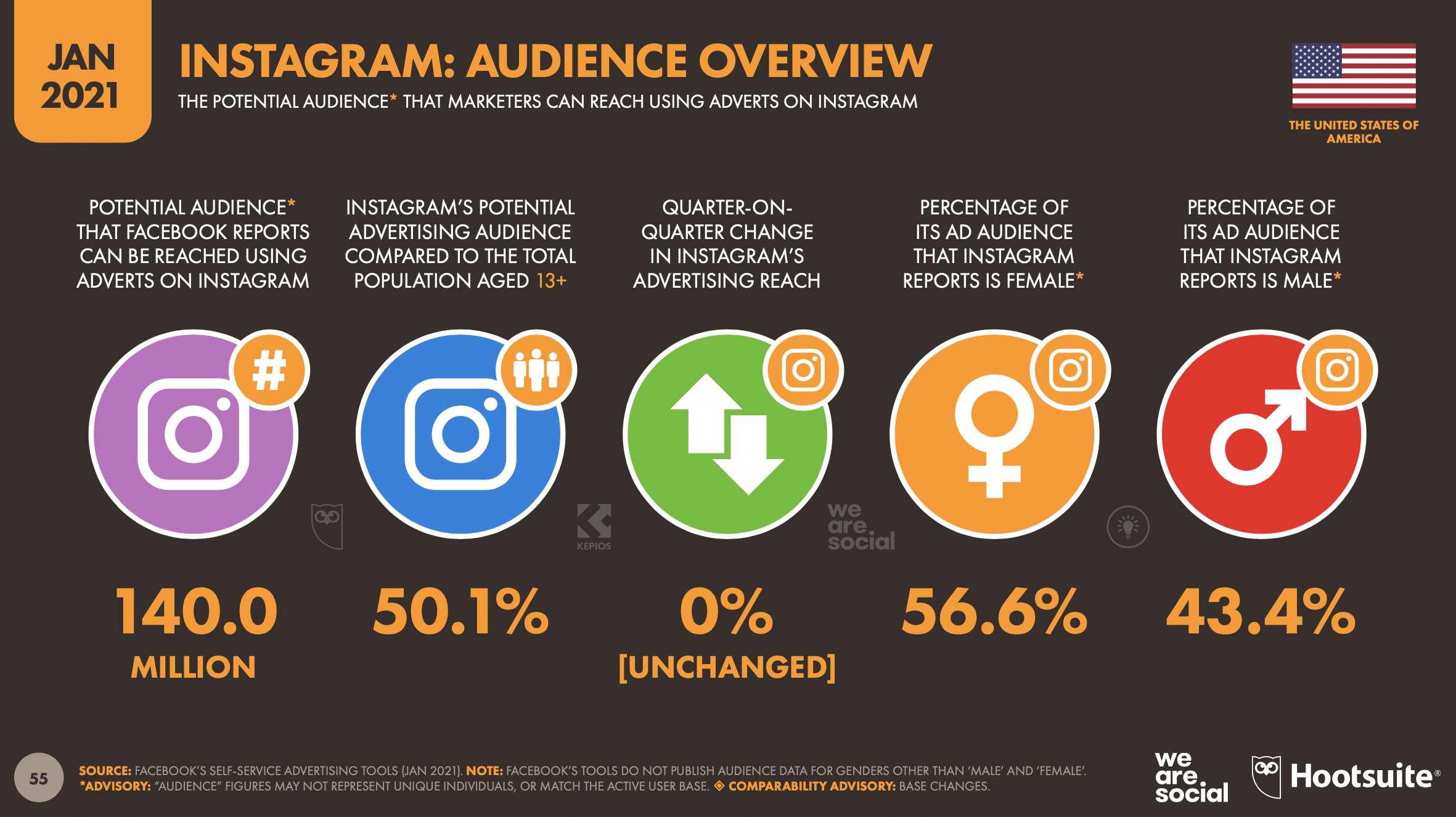

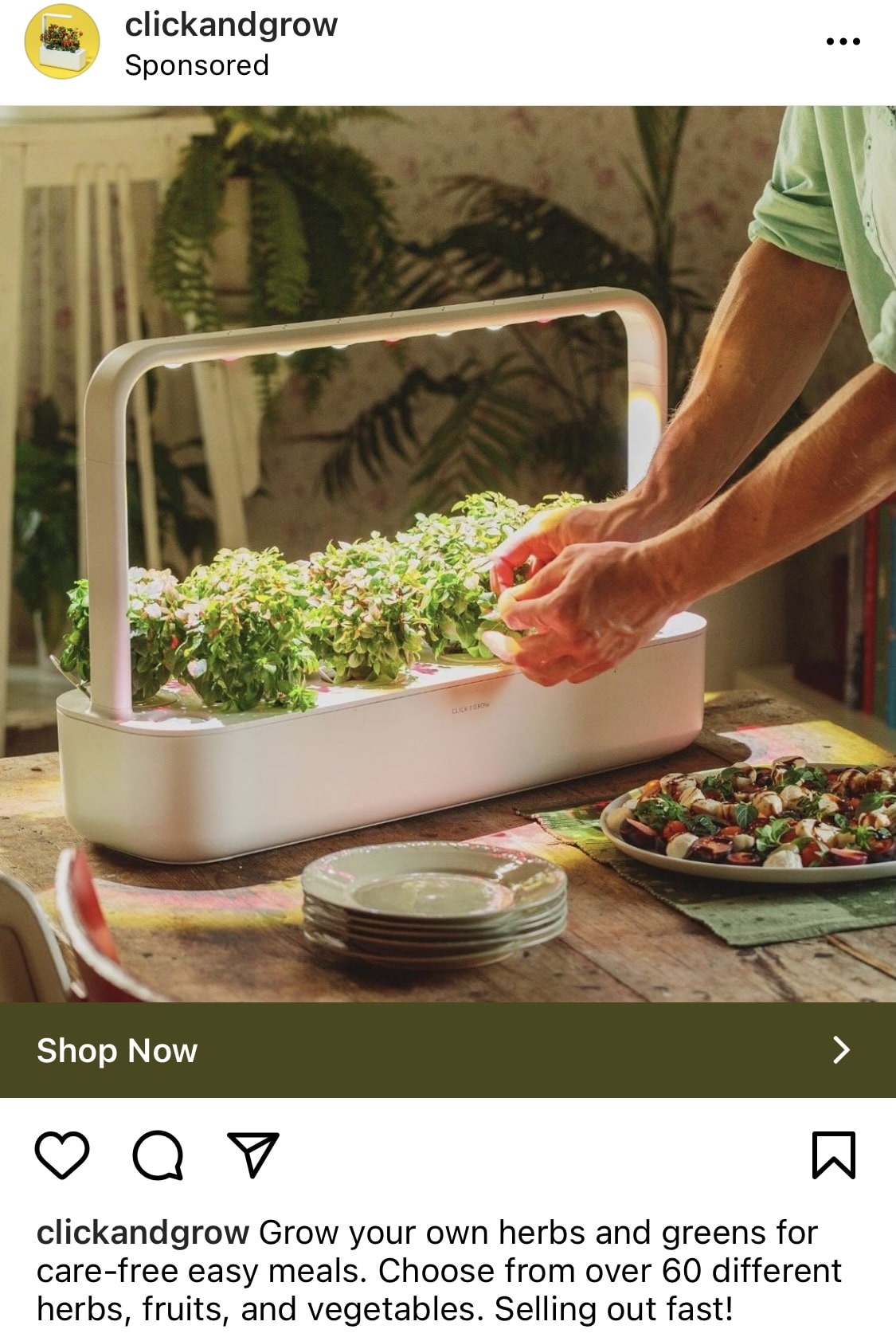

- Social media: Use hashtags and paid ads to expand your reach.

- Influencer marketing: Send free samples to “celebrities” in your niche.

- Facebook groups: Connect with your target market on this platform.

- Google advertising: Put your products in front of people all over the web.

- Content marketing: Publish blog posts to bring organic traffic to your site.

- Word of mouth: Encourage your customers to spread the word.

- YouTube videos: Start a channel to showcase your products.

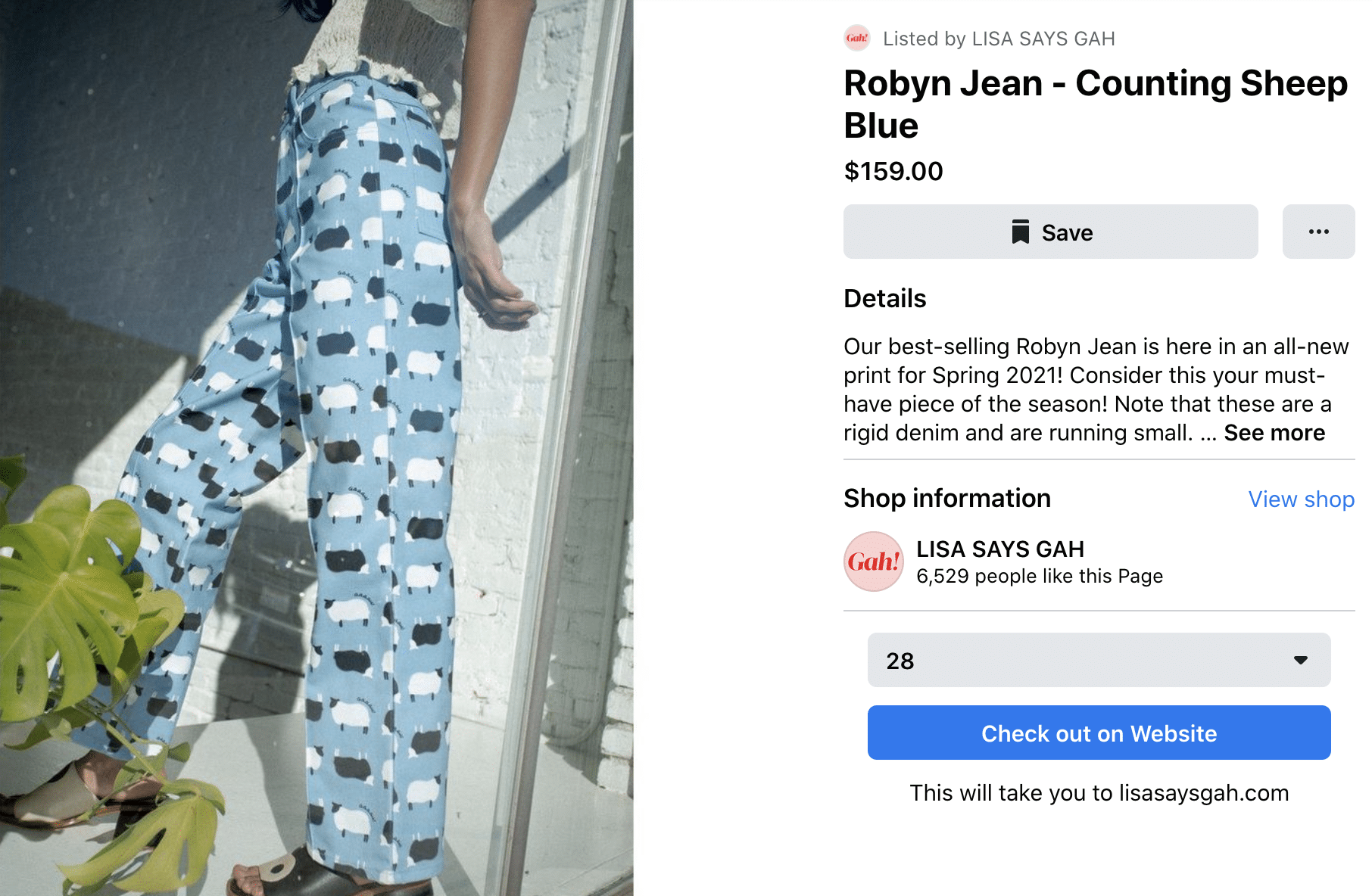

Although it’s possible to sell directly on social media pages, it’s good practice to drive traffic to your website so you can entice customers to join your email list. That way you’ll be able to follow up and maintain a connection with them in the future.

Funneling traffic to your website also allows you to send abandoned cart emails and other targeted promotions if visitors wander away before buying anything. You can also use Google Ads to retarget visitors who left your site, reminding them of the products they showed an interest in.

10. Continue to refine your approach

All the details that go into how to sell a product online may seem daunting. Besides the product itself, you need a brand identity, a target customer, a web store, and solutions for processing payments and handling shipping—and all of that needs to be in place before you even begin to market your product.

But these steps are manageable if you take them one at a time. Remember that you can continually change and refine your approach as you go.

The important thing is to take your first step, and before you know it, you’ll be riding momentum toward your goals.